Investor sentiment rose to 0.89 in 2Q17. From 0.88 in the first quarter of 2017 to 0.01. This is positive as 42 investors sold shares of Citrix Systems while 184 were underweight. 51 funds open positions, 150 to raise funds. It was reported that 122.38 million shares in the first quarter of 2017 decreased by 132.1 million shares, representing a decrease of 0.62%.

In a report to customers this morning, RBC Capital reiterated the “hold” rating on shares of Citrix Systems (NASDAQ: CTXS). The company’s latest price may slide -2.96%.

Investor sentiment rose to 0.89 in 2Q17. From 0.88 in the first quarter of 2017 to 0.01. This is positive as 42 investors sold shares of Citrix Systems while 184 were underweight. 51 funds open positions, 150 to raise funds. It was reported that 122.38 million shares in the first quarter of 2017 decreased by 132.1 million shares, representing a decrease of 0.62%.

Sun Life Finance said it owns 0.01% of its portfolio at Citrix Systems, Inc. (NASDAQ: CTXS). The Nj State Employees Deferred Compensation Scheme owns 20,000 shares. Pax Ww Mngmt said it has 40,000 shares, representing 0.18% of its total share. HSBC Limited accumulative 956,204 shares. Macquarie Co., Ltd. reported 71,900 shares. Chevy Chase Trust holds a 0.05% stake in Citrix Systems, Inc (NASDAQ: CTXS) for a total of 130,289 shares. Zweig owns 3,300 shares, representing 0.02% of its portfolio.

Manufacturer Life The Company owned 179,564 subsidiaries with a proportion of 0.02% of the shares sold. In addition, Greenwood Assocs Limited Com holds a 0.06% stake in the shares of Citrix Systems, Inc. (NASDAQ: CTXS). Fiera Capital Corp reported a 0% stake. Nuveen Asset Lc holds 0.16% of its portfolio at Citrix Systems (NASDAQ: CTXS) with 322,671 shares. Shares in Citigroup Systems Inc. (Nasdaq: CTXS) rose 0.83%, the U.S. giant oil giant Investment Adviser said. Redwood Investments Llc holds 15 shares or a 0% investment portfolio. Victory Cap Mgmt owns 21,466 shares, representing 0% of its portfolio. Shelton Cap Mngmt owns 12,060 shares, representing 0.07% of its portfolio.

Of the 23 analysts involved in Citrix Systems Inc. (Nasdaq: CTXS), 13 were rated, 3 are sold and 7 are held. So 57% are positive. Citrix Systems Inc. has a minimum target of $ 104 and a minimum of $ 56. The average target of $ 85.68 is -2.18% below the current $ 87.59 share price. According to SRatingsIntel, Citrix Systems Inc. has a total of 73 analysis reports since July 29, 2015. William Blair maintained his rating on the Market Perform on Thursday, August 20. On Thursday April 21, Stifel Nicolaus maintains a CTXS stock report “Buy” rating.

The company was “Outperform” by Robert W. Baird on Thursday, April 21. As of Thursday, June 1, Jefferies maintains a company rating. BTIG Research released a “Neutral” rating on Thursday, September 10. Barclays Capital gains “overweight” rating on Thursday, August 3. UBS gets “Neutral” rating on Thursday, April 21. Shares of Citrix Systems Inc. (NASDAQ: CTXS) have been “executed” at Oppenheimer on Wednesday, Nov. 18. The stock was “bought” by M Partners on Thursday, April 21. Mizuho maintains Citrix Systems Inc. (Nasdaq: CTXS) on Wednesday, August 2. Mizuho has “Buy” rating and $ 9,400 target.

The stock rose 0.48% or 0.42 U.S. dollars to reach 87.59 U.S. dollars last trading day. Turnover of about 116 million shares. Citrix Systems, Inc. (Nasdaq: CTXS) has risen 26.42% since December 10, 2016, and is on the uptrend. The S & P 500 outperformed the broader market by 9.72%.

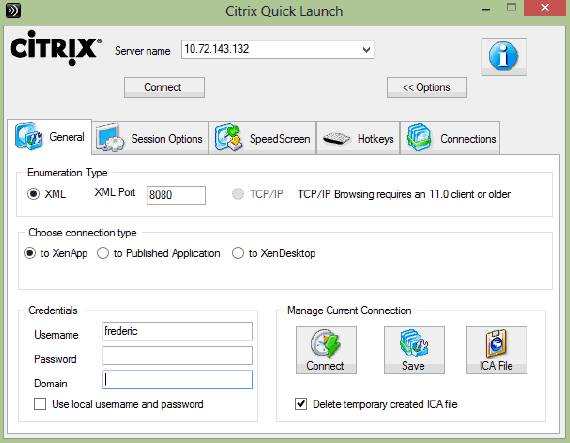

Citrix Systems provides an integrated platform for secure applications and data delivery, as well as networking capabilities as a global cloud service. The company’s market capitalization reached 132 billion US dollars. The company provides workspace services, including XenDesktop, a cloud-enabled desktop virtualization solution that gives customers the flexibility to deliver desktops and applications as a service for cloud and local data centers; and XenApp, which enables Windows applications as cloud services Deliver to Android and iOS mobile devices, Macs, PCs and thin clients. It has a P / E of 29.67. The company’s workspace services also include the XenMobile Enterprise Mobility Management Solution; and the Citrix Workspace Suite for applications, desktops, branch networks and WANs, enterprise mobility management and data solutions.